ena

ena

Ethena is a synthetic dollar protocol built on Ethereum, designed to maintain stability and function independently of traditional banking. It introduces a stablecoin called USDe, which serves as a digital asset collateralized by crypto assets. Unlike stablecoins like USDC or USDT, USDe operates within the Ethena ecosystem using a hedging strategy to manage volatility. This approach fosters a decentralized financial system that expands the utility of synthetic dollars in the crypto market.

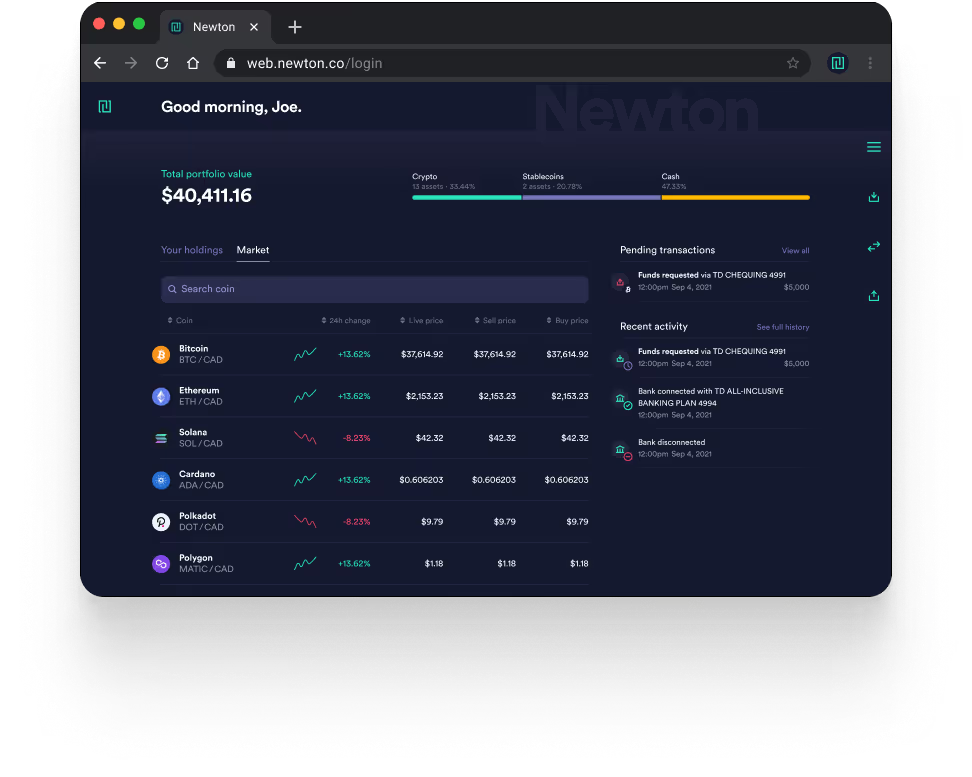

This coin is available on Newton.

A key innovation of Ethena is the Internet Bond, a novel financial instrument that combines staking and derivatives. This bond allows users to access a dollar-denominated savings tool powered by blockchain technology. By integrating liquidity provision and risk management, Ethena enhances opportunities for both retail and institutional participants. The Internet Bond represents a step toward creating a parallel financial system beyond fiat currencies.

The ENA token is used within the Ethena ecosystem for governance and liquidity provision. As the governance token of the Ethena ecosystem, it allows ENA token holders to influence decisions related to ecosystem development. The token also plays a role in market operations, with its price of Ethena fluctuating based on market capitalization and technical analysis. ENA is actively traded on cryptocurrency exchanges and platforms, offering liquidity to crypto investors.

Ethena markets benefit from a community-driven approach, enabling broader adoption of its synthetic dollar protocol. The total supply and market cap of ENA impact its trading activity and long-term value. As a relatively new entrant in the crypto market, Ethena continues to evolve, shaping how stablecoins like USDe integrate with DeFi. Its reliance on blockchain technology and collateral-backed assets makes it a key player in the future of decentralized finance.

For those looking to get started with Ethena, a wallet is required to store and trade ENA tokens. The information provided about Ethena is for informational purposes only and does not constitute investment advice. Factors such as crypto taxes, trading fees, and third-party exchange listings influence the accessibility of ENA. As Ethena grows, its role in the broader crypto market will continue to expand, offering an alternative to traditional financial systems.

Ethena’s core is built around USDe, a synthetic dollar that is fully backed and operates transparently on-chain. This token maintains its peg using collateral and a strategy called delta hedging, which offsets price risks with short futures positions. This approach helps keep USDe stable while allowing it to function efficiently in DeFi. As adoption grows, Ethena’s role in the cryptocurrencies market continues to expand.

Minting USDe begins when users request a price from Ethena’s Pricing API and generate a signed order. Ethena’s server verifies the order before sending it to the blockchain for execution. Once confirmed, users receive USDe, and slippage controls help prevent price inconsistencies. This process blends decentralized and centralized elements, creating a system that balances efficiency with trust.

Users can stake USDe by transferring tokens into the StakedUSDe smart contract and receiving sUSDe in return. These staked tokens generate passive income based on the protocol’s yield model. The earnings come from multiple sources, making the system attractive to those seeking stable returns. ENA is used within Ethena’s ecosystem, contributing to governance and protocol growth.

Ethena’s yield comes from two main sources: staking ETH and funding and basis spreads from delta hedging in derivatives markets. The protocol benefits from market fluctuations, allowing it to generate sustainable returns. Ethena’s performance and current market cap are influenced by broader trends in cryptocurrencies, including movements in Bitcoin. Investors remain bullish on Ethena’s model due to its structured yield strategies.

Backed by firms like Dragonfly and supported by platforms like Bybit, Ethena continues to grow within the DeFi space. Its hybrid model combines decentralized technology with risk management strategies. Third parties contribute to market stability, helping USDe maintain its peg. As demand rises, Ethena could reach new milestones, potentially surpassing its highest price in the future.

Ethena (ENA) offers unique features that differentiate it from Bitcoin and other digital assets. Here’s a comparison:

USDe is an integral part of the Ethena ecosystem, functioning as a stable digital asset. Here’s how it works:

Ethena (ENA) plays a key role in the DeFi ecosystem, offering financial tools without intermediaries. Here’s what makes it unique:

Ethena (ENA) incorporates mechanisms to help manage price fluctuations in the crypto market.

The ENA token plays a key role in the governance of the Ethena ecosystem. Holders can vote on important protocol decisions related to risk management, asset backing, and strategic partnerships. This decentralized governance model allows the community to have a say in the protocol’s direction. Voting power is proportional to the number of tokens held by each participant.

Beyond governance, ENA serves as a utility token within the platform. It is used in various incentive mechanisms, including staking rewards and liquidity provision. Participants who contribute to the ecosystem by providing liquidity or staking can earn additional ENA tokens. This structure encourages long-term engagement from users.

ENA is also an essential part of the staking and rewards system. Users can stake their USDe holdings to earn yields that are often higher than traditional financial products. The protocol distributes rewards to incentivize continued participation.

To maintain the stability of USDe, Ethena uses a delta hedging strategy. This approach minimizes the impact of Ethereum’s price fluctuations on the synthetic dollar’s value. By balancing positions in derivatives markets, the protocol keeps USDe aligned with the US dollar. The system relies on efficient risk management to maintain consistent value.

ENA’s role extends to supporting liquidity and engagement within the ecosystem. Token holders who actively participate in governance and staking could benefit from ongoing rewards. This reinforces a sustainable model where participation drives value. As the ecosystem grows, ENA continues to be a vital component of its decentralized structure.

Ethena's history began in July 2023 when it was founded by Guy Young as a crypto-native “Internet Bond” designed to be censorship-resistant, scalable, and stable. The project gained momentum with the public launch of its stablecoin, USDe, on February 19, 2024. On the same day, Ethena introduced Epoch 1 of its Shard Campaign, designed to distribute rewards to participants. Initially, the campaign was set to end after three months or once USDe’s total supply reached 1.00 billion.

One week later, the campaign progressed to Epoch 2, following a rapid increase in USDe’s supply to 600.00 million. As the supply continued to grow, additional integrations and adjustments to the shard multiplier were introduced at milestones of 800.00 million and 900.00 million tokens. USDe eventually reached a supply of 1.00 billion on March 13, 2024, fulfilling the campaign’s original completion criteria. However, Ethena later announced that the Shard Campaign would officially conclude on April 1, 2024.

Following this, Ethena launched its governance token, ENA, on April 2, 2024, marking the beginning of a new phase in the platform’s development. Alongside ENA, the team introduced the Sats Campaign to drive further ecosystem growth. This campaign is scheduled to end on September 2, 2024, or when USDe’s supply reaches 5.00 billion, whichever happens first. These initiatives reflect Ethena’s ongoing efforts to expand participation and engagement.

On April 4, 2024, Ethena took a significant step by adding BTC as a collateral asset for USDe. By this point, both Ethena and its USDe token were fully operational, with real-time data on collateral, perpetual swaps, staking, solvency, and yields publicly available. The platform continues to refine its features while attracting more users to its ecosystem. This development reinforced Ethena’s position in the evolving crypto landscape.

Looking ahead, Ethena plans to introduce a governance process that will allow ENA tokenholders to vote on key decisions. This system is expected to shape the platform’s future policies and operational structure. However, no further details have been disclosed regarding how or when this governance model will be implemented. A thorough review of available sources has not revealed any additional information on its timeline or framework.

Crypto taxes apply to ENA transactions, and traders should be aware of reporting requirements. Here’s what to consider:

Ethena (ENA) is a digital asset that plays a key role in decentralized finance (DeFi) applications. Here’s how it is used:

The live price of Ethena (ENA) can be tracked using various crypto platforms and financial tools. Here’s where you can monitor it:

Ethena (ENA) can be stored in a personal wallet or on regulated platforms such as Newton. Observing its circulating supply and market trends can provide a general understanding of its activity in the crypto space.

Some platforms offer staking for Ethena (ENA). This involves transferring ENA to a compatible platform and allocating tokens for network participation. Staking terms and potential rewards can vary by platform.

ENA may be used for transactions with businesses that accept cryptocurrency payments. Checking the current price and any relevant transaction fees is recommended before making a purchase. Availability of ENA as a payment option depends on the individual merchants and service providers.

Ethena Network enables digital transactions, allowing ENA to be transferred between users. To send ENA, the recipient’s wallet address is required, and transactions are processed on the network. Transaction fees may vary depending on network conditions.

Ethena (ENA) is accepted by some organizations as a form of donation. Digital donations are made by transferring ENA to the recipient’s wallet address, providing an alternative method for charitable contributions.

ENA can be exchanged for other cryptocurrencies, such as Bitcoin or Ethereum, on certain platforms. The options available for swapping ENA will depend on the platform’s supported markets.

*Newton does not currently support staking, governance, interest-earning, or other utility functions, where applicable, for this asset.

Ethena (ENA) can be obtained from private sellers or unregulated sources, though this comes with risks. Verifying a seller’s legitimacy may be difficult, and there is a possibility of encountering scams or fraudulent transactions. Without regulatory oversight, security measures may be limited, so considering potential risks before proceeding is important.

In Canada, Ethena (ENA) is available on regulated platforms like Newton. Newton platform accepts payment methods such as e-Transfers and wire transfers, providing a structured way to buy and sell digital assets. It also offers access to over 70+ cryptocurrencies, along with real-time price tracking and market data, which may be useful for monitoring holdings.

Live pricing updates for Ethena (ENA) are provided, allowing you to monitor market fluctuations in real-time. By comparing buy and sell prices, you can stay informed of market activity and make decisions based on current trends.

Various security measures are in place to protect your account and digital assets, including multi-factor authentication, login activity tracking, and anti-phishing features. Additionally, trusted devices can be managed to add security during account access.

Newton makes it affordable to buy and sell ENA, with a 1.50% - 1.60% fee. For more information about fees, see our Prices page. Newton covers up to $5 of network fees on your first daily withdrawal. For additional withdrawals, or if network fees exceed $5, the estimated network fee is confirmed prior to withdrawal.

Access is available on both desktop and mobile devices, enabling you to manage their holdings from virtually anywhere. Market changes can be tracked, balances checked, and transactions executed whether at home or on the go. The platform adjusts to various screen sizes for consistent usability.

Newton offers a simple and clear interface designed to be easy to navigate. You can track live cryptocurrency prices, review transaction history, and manage holdings with minimal effort, creating a smooth experience.

As a Canadian-based cryptocurrency platform, it provides access to Ethena (ENA) along with other digital assets. Designed with Canadian users in mind, it offers a local option for digital asset trading within the Canadian financial framework.

You must first create an account to begin using Newton for Ethena (ENA). This process includes registration and identity verification. Once completed, you will have access to the platform's cryptocurrency trading functionalities.

Then fund your account before making a purchase of ENA. Newton accepts payments via Interac e-Transfer and wire transfer for CAD deposits. Newton platform will guide you through the deposit process to complete it correctly.

Once your account is funded, you can proceed to purchase ENA. Newton provides a price chart that reflects the current value of ENA at the time of the transaction.

ENA can be found alongside other cryptocurrencies on the Newton platform. It is included in the platform's list of supported digital assets, which also features Bitcoin, Ethereum, and other tokens.

You have the option to specify the amount of ENA to buy, either by selecting a number of tokens or their equivalent value in CAD. The platform allows you to adjust the quantity based on your preferences.

After reviewing the details of the transaction, you can confirm the purchase. Once completed, ENA will be credited to your account, where it can be held or managed as required.

When you store Ethena (ENA) in a personal wallet, you have full control and custody of your asset, but access requires private keys. It is important to manage these keys securely, as losing them could result in the inability to recover your tokens.

ENA can also be stored in your Newton account, which provides security features such as multi-factor authentication and login history tracking. Additional tools, like trusted device management and anti-phishing protection, help safeguard your account.

Your security is important. Newton is committed to being a leader in compliance, security, and technical protocols.

For additional information and to review the risks associated with Ethena, please see our Asset Statement.