Mindshare at scale is rare in crypto and Ethereum achieved it. The blockchain’s early success was shaped not only by its founders but also by the many contributors who built permissionless applications, helping ETH secure its position as the second-largest digital asset by market cap. From Uniswap’s DeFi activity to OpenSea’s NFT marketplaces, thousands of applications fueled Ethereum’s early ascent, but even established networks can face setbacks.

Throughout 2024, Ethereum encountered challenges that left room for competitors to gain ground.

Transaction costs and scaling issues gave way to speculation that Solana might be better positioned to capture new activity.

The surge of meme token trading and the popularity of projects like Pump.fun placed Solana in the spotlight, leading some observers to question Ethereum’s position in the ecosystem.

For people following Ethereum, 2025 has felt like a course correction, with recent Foundation decisions seeming to line up with a more supportive regulatory environment.

On Wednesday it was widely circulated among crypto news outlets that an analyst from J.P. Morgan's team had published a report outlining some of the reasons Ethereum has recently outperformed Bitcoin. The analysts findings were as follows:

Ethereum had been hovering around all-time highs for weeks, and broke through to new levels on Friday the 22nd. This price milestone followed promising rate news from US Fed Chair Jerome H. Powell. The Chair suggested during his Jackson Hole speech that “with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.”

The GENIUS Act directly affects stablecoins, but if we take a step back, its impact reaches an entire industry that has been waiting for regulatory clarity through law. Crypto has often been placed under the spotlight for the actions of bad actors, but this is a large space, and we can’t discount the many participants who have worked to follow guidance and self-regulate.

Doing what appeared to be the right thing has not spared developers from unease, as many have wondered whether they might be fined or even face harsher consequences for building in the space. Recent regulation allows for some to breathe a sign of relief.

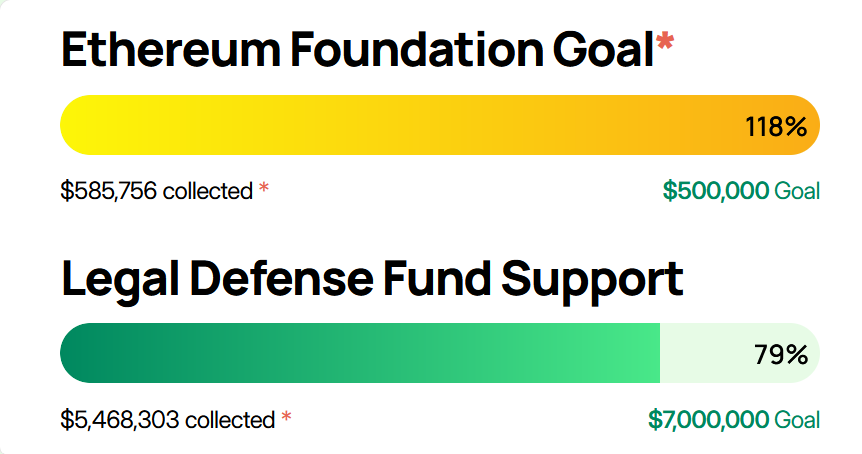

That isn’t to suggest all of the tension has diffused in this space. The August 6th conviction of Tornado Cash founder Roman Storm underscored the risks some developers face. The community has rallied over $5 million in support of his defense.

For those unfamiliar with the project, Tornado Cash exists on the Ethereum blockchain. Users can mix their cryptocurrency with other peoples to obscure trails and increase a transaction's level of privacy.

Zero-knowledge proofs (zk-SNARKs) are used to break the on-chain link between the sender and receiver. As such, decentralized mixers can and have been used to obscure transaction trails for bad actors. Cases like Storm’s show the risks developers face, but they also underscore why clearer laws are promising for an industry that appears beyond ready to move forward.

Ethereum’s renewed engagement with its builders and community feels like a significant reminder that open networks draw strength not only from technology, but also from how they evolve when law, on-chain governance, and people begin to align.

For Canadians, staying informed means keeping an eye on what’s happening across crypto projects. Learn more in our education series on the Newton Blog.